KBZ Bank introduced Special Fixed Deposit Accounts which can be deposited by cash or transfer from customers’ CASH ACCOUNT. Special Cash Fixed Deposit Account is suitable for the customers, who would like to earn a high-interest rate and have easy access to your cash.

Eligible Customers

Individual (Singly or Joint)

Organizations (NGO, INGO, Pagoda Trustees, Universities, etc)

Companies (DICA Issued Company Registration)

Businesses (Non-DICA Issued Company Registration)

High-Interest rate

Offer a higher interest rate than the normal Fixed Deposit Account.

Unlike saving deposit accounts, this account holder can deposit during any time of the month and still be eligible for interests.

Deposit

The deposit can be made from cash or transfer from CASH ACCOUNT. After completion of the fixed date of deposit, you may be able to withdraw the deposit together with the interest (in the bank your account was created)

Convenient Withdrawal

Ability to withdraw cash from CASH ACCOUNT – Call/Current (or) ordinary Current/Call account after the proceeds of FD have been transferred upon maturity.

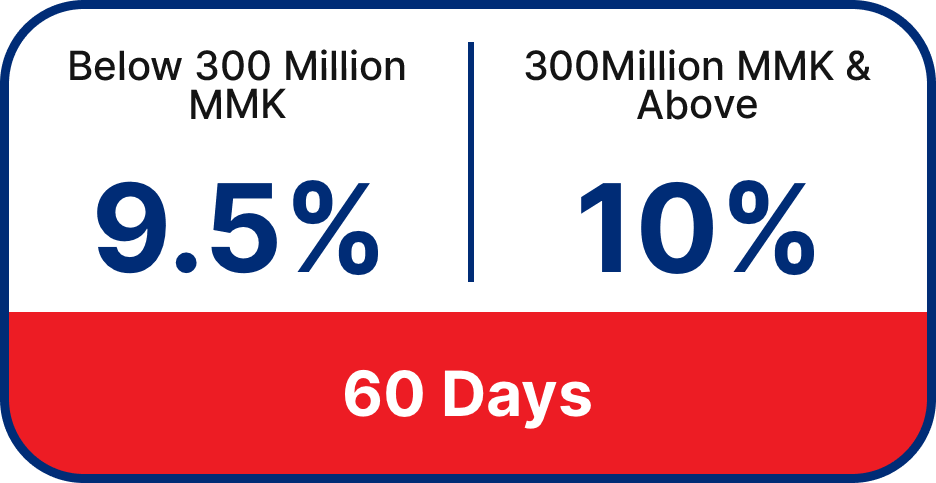

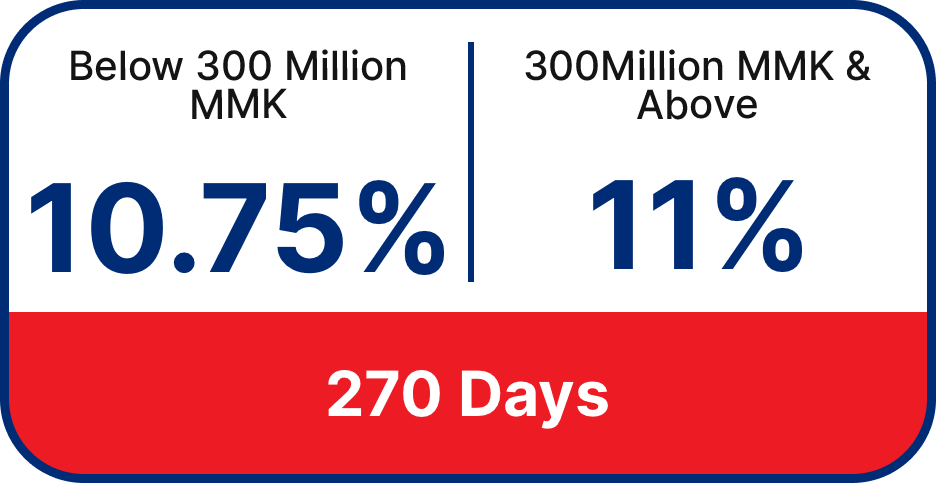

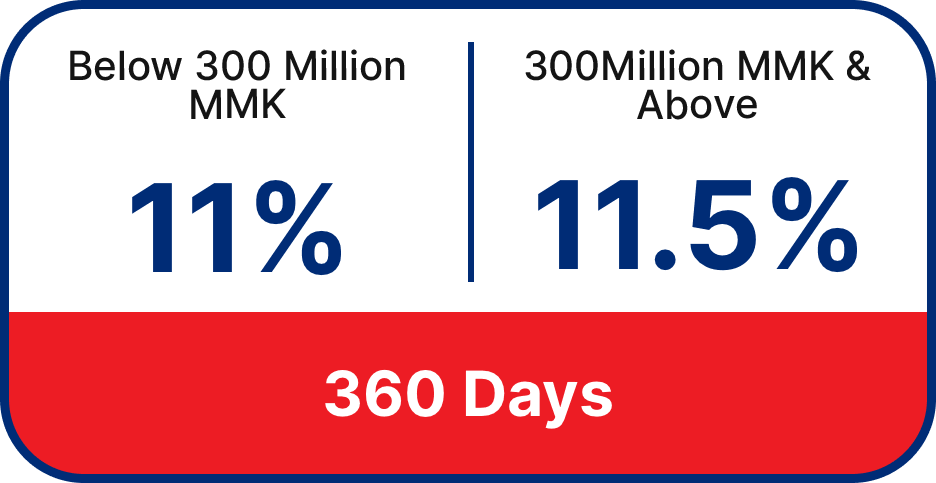

Terms of deposit and interests

*Effective as of September 1st, 2024

For more details about tenors and interest rates, please inquire at the nearest KBZ branch.

Primary Benefits

High-Interest rate

Watch your savings grow with our high interest rate

Joint account

Open an account by yourself or with someone else

Withdrawals

Make the most of KBZ’s generous and flexible withdrawal scheme

eFixed Deposit

– Open Fixed Deposit Accounts through m/iBanking at the comfort of your home

– Change the account maturity option from Auto Roll-over to Close on Maturity, and vice versa, easily on iBanking

Fixed deposit account is most suitable for individuals interested in long-term deposits and citizens, over the age of 18, are eligible to open a fixed deposit account.

Higher interest rates will be incurred depend on the length of the deposit term.

Opening an account

You can open an individual account or co-account with another person.

Withdrawal and deposit

After completion of the fixed date of deposit, you may be able to withdraw the deposit together with the interest (in the bank your account was created).

High-Interest rate

Eligible for high interest rates are dependent on the length of the deposit. Unlike saving deposit accounts, this account holder is able to deposit during anytime of the month and still be eligible for interests.

Initial Deposit 10,000 MMK

*Can deposit more than the required initial deposit.

Minimum Balance 10,000 MMK

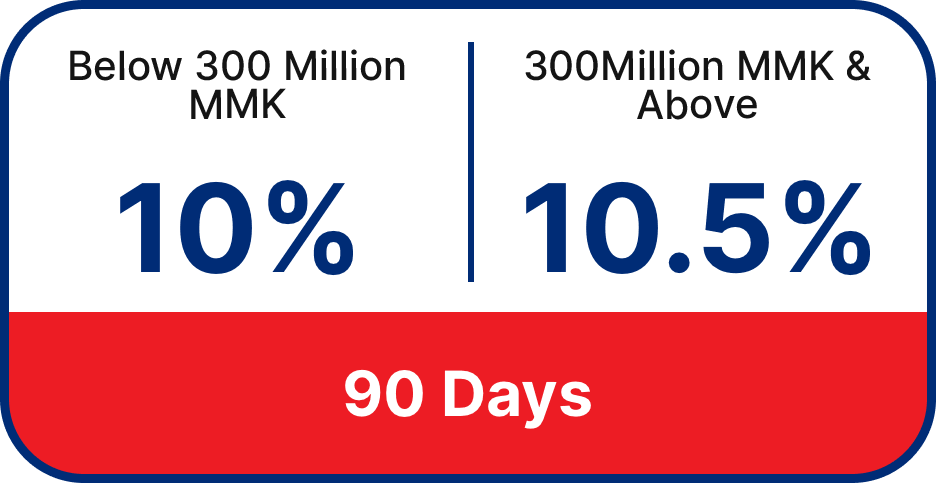

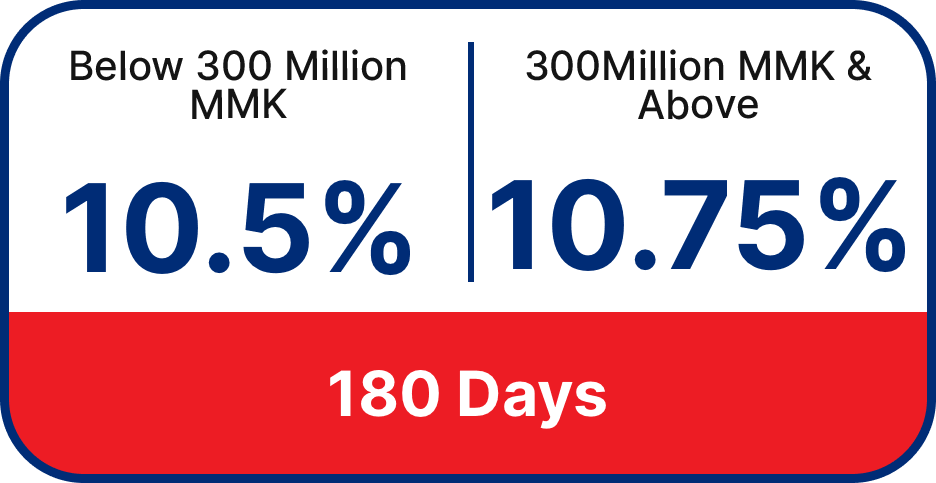

Terms of deposit and interests

*Effective as of September 1st, 2024

For more details about tenors and interest rates, please inquire at the nearest KBZ branch.

Fixed Deposit Account Calculator

Disclaimer: This Fixed Deposit Calculator provides estimates only. Actual returns may vary. Consult your bank for accurate details.

Primary Benefits

High-Interest rate

Watch your savings grow with our high interest rate

eFixed Deposit

− Open Fixed Deposit Accounts through m/iBanking at the comfort of your home

− Change the account maturity option from Auto Roll-over to Close on Maturity, and vice versa, easily on iBanking

KBZ Bank introduces Po Su Fixed Deposit Account – 360 days, which offers added flexibility than normal Fixed Deposit Accounts in the way that account holders are allowed to make a certain number of additional deposits (top ups) within a 90-day period after account opening and enjoy a higher interest rate when the eligibility threshold is reached. Po Su Fixed Deposit Account is suitable for customers who would like to make multiple fixed deposits for a longer tenor and earn a high interest rate.

Opening an Account

The following types of Po Su Fixed Deposit Accounts can be opened:

- Individual Account

- Joint Account

- Corporate / Association and Business Account

High Interest Rate

Po Su Fixed Deposit Account offers a high interest rate and also takes into account the funds topped up.

Top Up Process

Top up for a maximum of 10 times within 90-days after account opening.

Top up can be done at any KBZ branch and through a specified Pay In account.

The top up amount is added to the Certificate of Term Deposit after the top up process.

Minimum Top Up Amount: 50,000 Ks

Maximum Top Up Amount: 60% of Initial Principle

Deposit and Withdrawal

Minimum initial deposit: 100,000 MMK

The initial deposit can be transferred from a specified Pay In account.

After account maturity, the account holder shall withdraw to the PayOut account the total funds deposited together with the interest earned.

Tenor

This account has a tenor of 360 days and shall be closed on maturity.

Terms of Deposits and Interests

For more details about tenors and interest rates, please inquire at the nearest KBZ branch.

*Effective as of September 1st, 2024

Primary Benefits

High-interest rate

Save more and enjoy a higher interest rate once the initial deposit and additional funds topped up reach the high-interest threshold.

Convenience

Hassle-free banking since account holders do not need to open multiple Fixed Deposit Accounts or keep multiple Certificates.

Flexibility

Choose top up amounts that suit your preferences; top up for up to 10 times within 90-days after account opening

KBZ Bank’s Instant Cash Fixed Deposit Account is a high interest-earning fixed deposit account that lets account holders obtain interest instantly at the time of account opening.

Eligible Customers

The following types of customers can open the Instant Cash Fixed Deposit Account:

. Individual Account

. Joint Account

. Corporate (DICA), business (Non-DICA), and organization accounts (NGO, INGO, pagoda trustees, universities)

Earn Interest Instantly

No need to wait until account maturity. Get the interest upfront at the time of the account opening.

Minimum Initial Deposit

Open Instant Cash Fixed Deposit Accounts with a minimum initial deposit of 1,000,000 MMK.

Deposit and Withdrawal

Open customer-preferred Instant Cash Fixed Deposit Account types by transferring funds from any ordinary or special cash Call, Current or Savings Deposit Accounts. Similarly, funds upon account maturity are transferred to any designated ordinary or special cash Call, Current, Savings Deposit Account according to Instant Cash Fixed Deposit Account type

Terms of deposit and interests

*Effective as of September 1st, 2024

For more details about tenors and interest rates, please inquire at the nearest KBZ branch.

Primary Benefits

High-Interest rate

Earn up to 11.5% p.a. from Instant Cash Fixed Deposit

Earn interest instantly

Get the interest upfront at the time of the account opening.

KBZ Bank has introduced Monthly Growth Fixed Deposit Account, which stands out from other regular fixed deposit accounts in the way that the interest is liquidated monthly, ensuring regular earnings for account holders before account maturity.

Eligible Customers

The following types of customers can open the Monthly Growth Fixed Deposit Account:

. Individual accounts

. Joint accounts

. Corporate/association and business accounts

Earn Interest Monthly

Enjoy the benefit of earning interest monthly, providing account holders with regular income and greater financial flexibility.

Minimum Initial Deposit

Minimum Initial Deposit for Individual/Joint – 10,000 MMK

Initial Deposit for Corporate/Association – 100,000 MMK

Deposit and Withdrawal

Open customer-preferred Monthly Growth Fixed Deposit Account types by transferring funds from any ordinary or special cash Call, Current or Savings Deposit Accounts. Similarly, funds upon account maturity are transferred to the designated ordinary or special cash Call, Current, Savings Deposit Account according to Monthly Growth Fixed Deposit Account Types.

Terms of deposit and interests

For more details about tenors and interest rates, please inquire at the nearest KBZ branch.

Primary Benefits

Earn Interest Monthly

Interest is earned monthly, ensuring regular earnings

Flexibility

Use any Cash/Ordinary Call, Current or Savings Deposit Account as “Monthly Interest Payout Account”.