Yangon, Myanmar, 16 September 2020 – All holders of Myanmar Payment Union (MPU) debit cards which are registered to be used for e-commerce can now perform instant cash-in transactions to their KBZPay mobile wallet. The MPU Cash-In feature is available on the recently launched KBZPay 3.0 app upgrade and allows non-KBZ Bank customers to transfer funds to their KBZPay mobile wallets using a debit card issued by other local banks.

With more than 10 million cards issued1, MPU is the leading bank card network in Myanmar and offers co-branded debit and credit cards with leading local banks including KBZ Bank. The MPU Cash-In option is a new feature of the KBZPay 3.0 app version launched in August 2020. Since the soft launch of the MPU Cash-In feature in August 2020, more than 700 MPU cardholders have performed over 1,000 cash-in transactions valued at MMK 96 million to their KBZPay mobile wallets.

Mr. Chong Ho Yoon, Head of KBZPay, said, “Whether digitally or through physical cards, KBZPay and MPU are committed to creating convenient and safe payment experiences. We are delighted that the MPU Cash-In feature gives even more flexibility to our six million KBZPay customers across the country who can transfer money into their KBZPay mobile wallets instantly. More significantly, non-KBZ Bank customers can now instantly cash-in to their KBZPay mobile wallet using an e-commerce approved MPU card, making it easier to perform day-to-day financial transactions during this COVID-19 period when social distancing is encouraged.”

As the Myanmar population shifts towards mobile transactions, KBZPay released the updated app version with a new look, intuitive interface, enhanced features, as well as expanded product and service offerings.

“We already see a significant increase in the amount of money that KBZPay customers store in their mobile wallets. There was a 167 percent increase in customer funds in our system in June 2020 compared to January 2020. With the MPU Cash-In feature bringing more convenience to our KBZPay customers and MPU cardholders, we expect this number to continue rising,” added Mr. Chong Ho Yoon.

MPU debit card holders cashing into their KBZPay mobile wallet will be charged MMK 200 per transaction, with the maximum single transaction amount set at MMK 300,000 and the daily total transaction limit set at MMK 1 million.

To use the MPU Cash-In feature, KBZPay users will need to register their MPU card and mobile phone number for e-commerce with their bank. The e-commerce registration process can differ between banks.

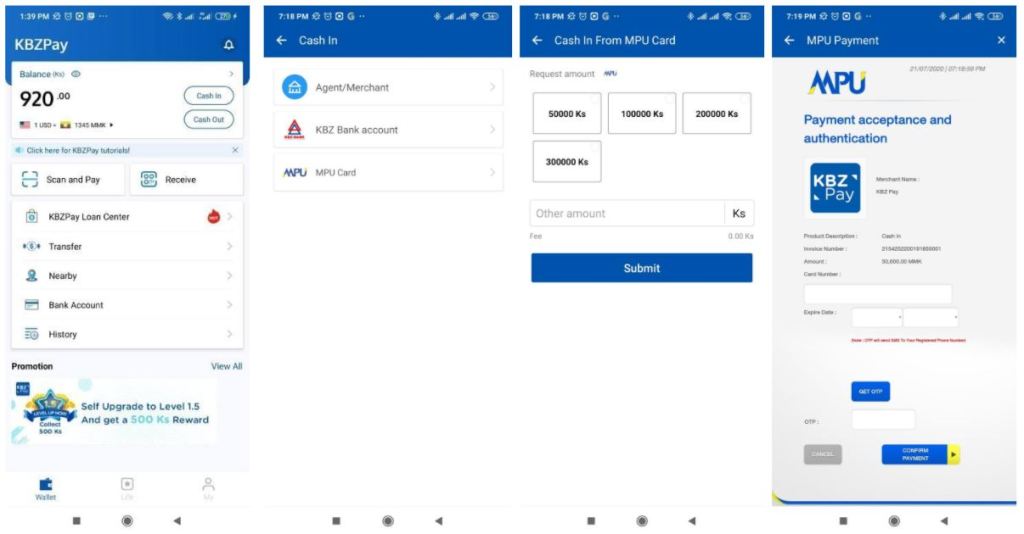

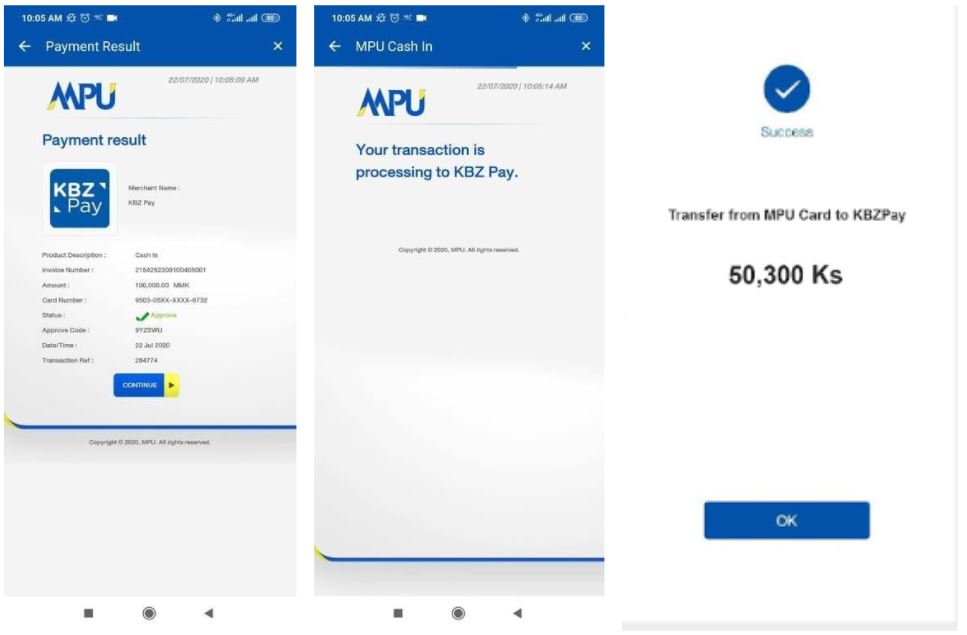

How to Cash-In to a KBZPay Mobile Wallet Using an MPU card

- Open the KBZPay mobile wallet and tap on “Cash-In” on the Wallet Tab.

- Choose the “MPU Card” option, select or type the Cash-In amount and tap “Submit”.

- Enter the MPU card number and its expiry date.

- Tap on “Get OTP” and type in the one-time password sent via SMS.

- Finally, hit “Confirm” to complete the process.

Video Tutorials on how customers can cash-in to their KBZPay mobile wallet using an MPU card are available on the KBZPay app and the official KBZPay Facebook page, www.facebook.com/KBZPay.

To download the updated version of the KBZPay app, please visit the Google Play Store and the Apple App Store.

1The Myanmar Times, 12 March 2020, Banking on a cashless future