- KBZPay partners to benefit from short-term financing and enjoy improved cash flow

- Easy loan application process without the need to present collateral

- Low interest rate and flexible repayment period offered

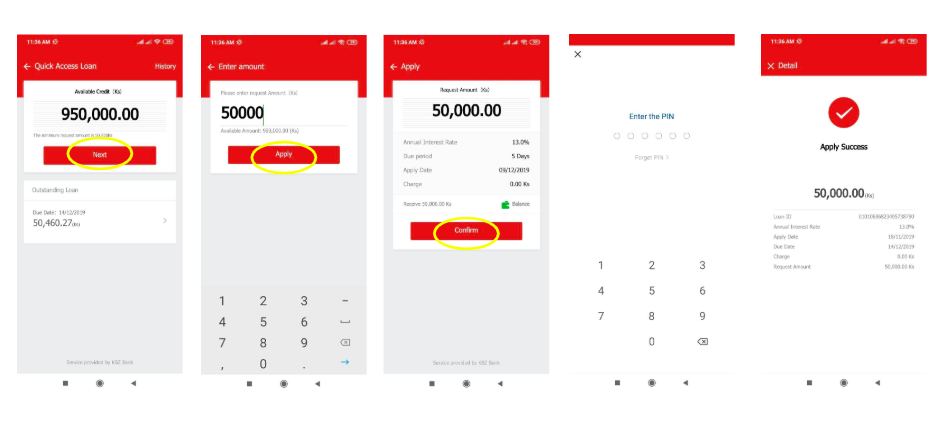

Yangon, Myanmar, 7 January 2020 – A new short-term financing product named KBZPay Quick Access Loan has been launched to help KBZPay agents and merchants improve their cash flow so they can better serve customers and grow their businesses. With the aim of driving financial inclusion, Quick Access Loan is available to all KBZPay Partners who can access instant credit of MMK 300,000 without the need to provide collateral, guarantors or application fees. There is further potential for KBZPay Partners to increase their credit limit up to MMK 2,500,000. The loan application takes a few minutes at any KBZ Bank branch and successful applicants will be able to draw down from the line of credit according to their needs using the Quick Access Loan function in the KBZPay Partner App.

The Quick Access Loan product was developed to address a growing need to support KBZPay Partners who were facing cash-flow issues. This meant they faced challenges facilitating ‘cash-in’, ‘cash-out’ and Peer-to-Peer (P2P) transactions for KBZPay customers as these require agents and merchants to have sufficient funds stored in their KBZPay mobile wallet. Quick Access Loan offers flexibility to KBZPay Partners as interest is only charged daily on the amount of credit they draw down, and repayment can be made at the convenience of the Partner. The repayment can be made after one day, and must be made within one month.

Since the pilot launch of Quick Access Loan in May 2019, close to 2,917 KBZPay agents and merchants have received loans totalling MMK 1.66 billion. As a result, they have seen their revenues grow due to the increase of KBZPay transactions they were able to facilitate for customers. KBZPay agents and merchants are growing their revenues as they earn fees for facilitating phone top-ups, domestic remittance, along with cash in and cash out transactions.

Said U Soe Ko Ko, Head of Agent Banking, KBZPay, “Many of our 270,000 KBZPay agents and merchants across Myanmar run businesses which need short-term financing that is quickly available. With our Quick Access Loan, we offer our partners a “financial cushion” for growth and working capital management. We are seeing an increase in KBZPay agents and merchants applying for Quick Access Loan and we hope to help thousands of our partners to run their businesses smoothly and to serve their customers in the best possible way. As they increase their KBZPay transaction volumes, our partners not only earn more transaction fees, but they will also be eligible to borrow larger amounts so they can scale their growth. After all, the success of our partners’ businesses is also our success.”

Application and Terms of KBZPay Quick Access Loan

KBZPay agents and merchants can visit any of KBZ Bank’s 500 branches to apply for Quick Access Loan free of charge. They will need to fill up an application form with the requested loan amount and provide proof of identity as a partner of KBZPay. The loan amount disbursed will be determined based on the amount and volume of KBZPay transactions facilitated by the applicant in the past.

Provided the loan check is positive, the line of e-credit provided is one year with a monthly repayment schedule. The interest rate is 13 percent, applied only to the e-credit amount used. The eligible loan amount will increase as agents and merchants increase their monthly transactions and repay their loans on time.

The following describes the usage of Quick Access Loan e-credit and the repayment process:

- A KBZPay agent, Daw Nilar, receives e-credit of MMK 300,000 in November 2019. She is able to check her e-credit balance using the Quick Access Loan feature in her KBZPay Partner App.

- One day, a customer requests for Daw Nilar to ‘cash-in’ MMK 50,000 into the customer’s KBZPay mobile wallet. As Daw Nilar does not have enough funds in her KBZPay Partner App, she uses her e-credit to facilitate the transaction. Daw Nilar accepts cash payment from the customer and her e-credit balance becomes MMK 250,000, though she earns a transaction fee for facilitating the ‘cash-in’ request.

- A few days later, Daw Nilar receives payment via KBZPay from a customer buying goods at her store amounting to MMK 80,000.

- Daw Nilar decides to use the funds in her mobile wallet to repay the e-credit amount of MMK 50,000 used a few days before. Using the Quick Access Loan feature in the KBZPay Partner App, she makes payment of the amount with a low interest amount calculated based on a daily rate. Following that, her e-credit balance returns to MMK 300,000.

KBZPay agents and merchants can also top-up funds into their mobile wallet by linking their KBZ Bank Savings account or depositing cash at the nearest KBZ Bank branch. In addition to the hassle-free loan application, disbursement and repayment process, KBZPay partners will receive intensive customer support and visits from the KBZPay team.

“I am so glad that KBZPay has supported my business with a Quick Access Loan. The Quick Access Loan application process was simple and free of charge. After a few days, I received a notification that I had received the requested loan amount in the form of e-credit and immediately, I felt a burden off my shoulders. I can use the e-credit whenever it is needed to help customers. For example, I recently used e-credit to perform a money transfer via KBZPay for a customer who needed to send money to her family urgently. If I did not have the e-credit, I would have had to turn away such customers. Using the cash received from the customer, I easily made repayment of the e-credit the next day without incurring interest,” said Daw Tin Tin Cho, a KBZPay agent who owns a restaurant in Mingalardon Township, Yangon.

In the coming weeks, the KBZPay team will reach out to agents and merchants across Myanmar to introduce Quick Access Loan to them. KBZPay agents and merchants can contact the KBZPay team at

3212 to find more about the KBZPay Quick Access Loan.